Equities rose again in August, in spite of the ongoing global COVID-19 economic slump and confirmation of Australia being officially in recession.

While the Australian dollar continued its rise, up 3.2% to $0.7375 by the end of the month, that didn’t offset the very strong gains in US stocks. The S&P500 index in the USA gained 7.19%, and the tech heavy NASDAQ gained 9.7% in August (but has subsequently dropped just over 5% in the last week).

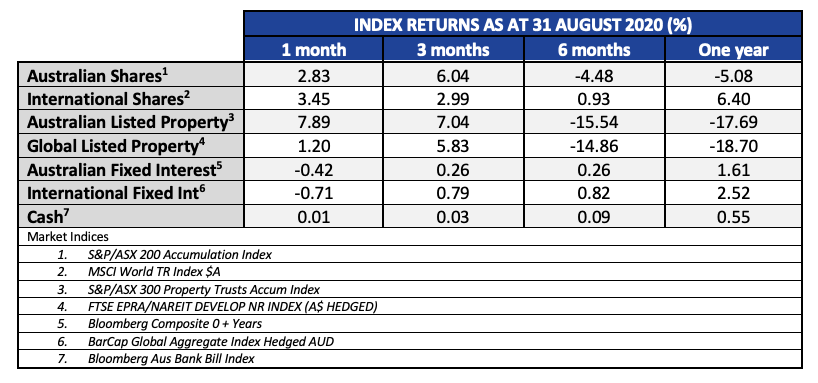

European markets were more muted during the month with the German DAX the best, up 5.13%. Looking at our table below, you can see the divergence between global and Australian stocks over the last year, which reinforces the benefits of portfolio diversification.

The property assets reflected in the table are listed property securities traded on major stock exchanges, not residential property, which has very little representation in these indexes. For more a detailed update on the residential property market, have a read of Peter Kirk’s Australian Property Market Outlook (September 2020) article.

A major component of the indexes are office and retail properties, both of which are vying for the ‘most hated’ asset class label at present.

Work from Home and Shop from Home are the current trends, and few investors are willing to bet on a return to the ‘old normal’. There is no doubt that trends are changing, thanks to COVID-19 but it is in these times – during extreme negative sentiment – that bargains are found.

Fixed income markets saw losses in August, as yields rose in the longer maturity bonds. The ten year Australian Government bond started the month at 0.83% yield to maturity and ended the month at 0.98% yield. A rise of fifteen basis points (0.15%) results in a 1.20% loss in the value of a bond. Although yields rose, causing a drag on prices, credit spreads continued to come down, offsetting some of the loss from rising yields. Still, the index for both Australian bonds, and global bonds were both lower in August.

If you have any questions about our August 2020 Financial Market Review, please get in touch.