This week a few things have caught my eye that are having and impact, or will have an impact on investment markets and portfolios in the coming months. This article is a quick and easily digestible summary of these items: Home prices to jump, bonds and the latest meeting of the US Federal Reserve.

Bonds

Franklin Templeton bond strategists said in a note:

“Bonds in this coming era more resemble certificates of confiscation than certificates of income from governments eager to reflate economies and deflate their debt piles. The bond frogs get boiled nice and slowly as savers capital is sacrificed further in favour of over leveraged debtors”.

There are many white papers doing the rounds which speak about the role of bonds in a portfolio and how the ultra-low yields, and extended maturities means their contribution to balanced portfolios is going to be very different (i.e. lower) in the next ten years compared to the last ten.

Federal Reserve meeting

The last meeting of the Federal Reserve in the USA prior to the November election was held this week. The meeting pretty much confirmed what we already knew, that they will keep interest rates near zero through to 2023.

The market, looking for a little more than that, sold down towards the end of his speech on Thursday. Not much in the way of new stimulus being announced saw profit takers move in.

What is important though, is that the current low rates, and willingness to allow inflation to run hot for a while, is confirmed. It is open slather for the carry trades, and likely to mean that any dips are met with buying.

While some of the highest flying growth names may sell down, there are other sectors that will benefit longer term from the low cost of capital.

Home prices to jump

Property indexes are now reflecting falls in home prices in Sydney and Melbourne, but in Brisbane and the Gold and Sunshine Coasts, prices appear to be remaining very solid. In fact, the ‘on-the-ground’ commentary from real estate agents and locals is that everything coming onto the market is selling very quickly.

Also Read: Australian Property Market Outlook – 10 September 2020

While our natural inclination is to be wary about what happens when the bank ‘forbearance’ turns into ‘foreclosure’ we do need to think about the alternative possibilities. Back in April, Westpac had predicted an 8% slide in Brisbane home prices, and have now pared that back to a 2% forecast dip by mid 2021.

Record low interest rates and easy credit will fuel a 15 per cent surge in national prices between 2021 and 2023. But prices will fall until mid-2021 https://t.co/uhwNsIvNyl

— Financial Review (@FinancialReview) September 17, 2020

In an update reported in Thursday’s AFR, they now believe that dip will be followed by a 20% rise in home prices from 2021 to 2023. Is that just wishful thinking? It was after all a bank economist forecast!

The reality is that we are looking at a minimum of three years of near zero official interest rates, and a fiscal policy regime which is more supportive than ever in history. Money has to go somewhere, and one can make an argument that a 3% net yield on a residential property actually looks OK.

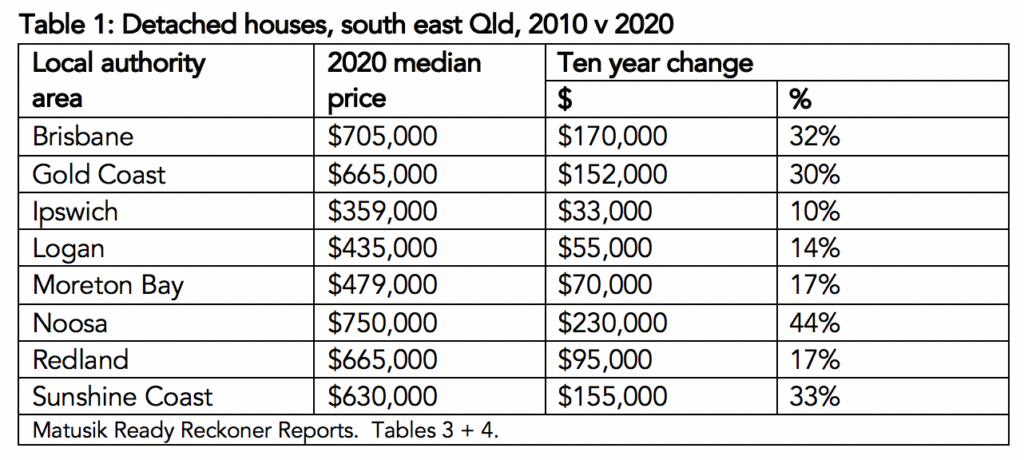

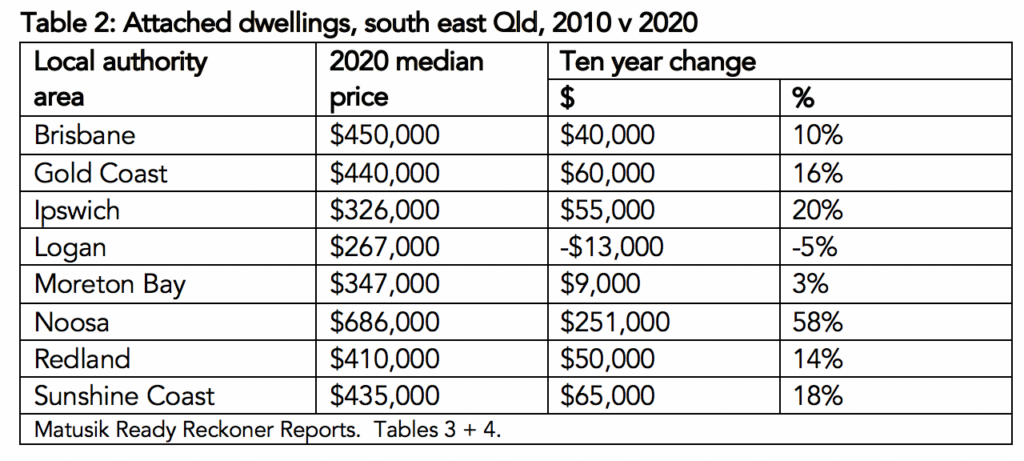

Michael Matusik also sent his ten year history update with median home prices for the ten years from 2010 to 2020.

The price of the median detached dwelling over that time for Brisbane, Gold Coast and Sunshine Coast increased by 32%, 30% and 33% respectively.

Stamp duty and sales commission will take a chunk of your returns as an investor, and tenant hassles may drive you mad, but this context may be useful in thinking about your property strategy. Michael Matusik provides some excellent demographic guides for anyone looking to make serious property decisions.

Get in touch if you want to see some of his work.