The S&P/ASX 200 Accumulation Index increased +2.55% in March while the MSCI World Index (A$) was also higher at +4.42%. The global equity indexes were assisted by the conversion back into Australian dollars as our currency fell by 1.3% from USD 0.7696 to USD 0.7595.

The S&P500 was particularly strong, up 4.22% in USD terms, and even more for Australian investors when you add in the effect of the weaker AUD.

These very good results come on a backdrop of concerns about elevated valuations. There is no doubt that sectors of the market are very expensive. However, with stimulus continuing to pour into the real economy through fiscal means, and central banks holding a firm line that rates at the short end are not going up any time soon, there appears to be the likelihood of continued momentum.

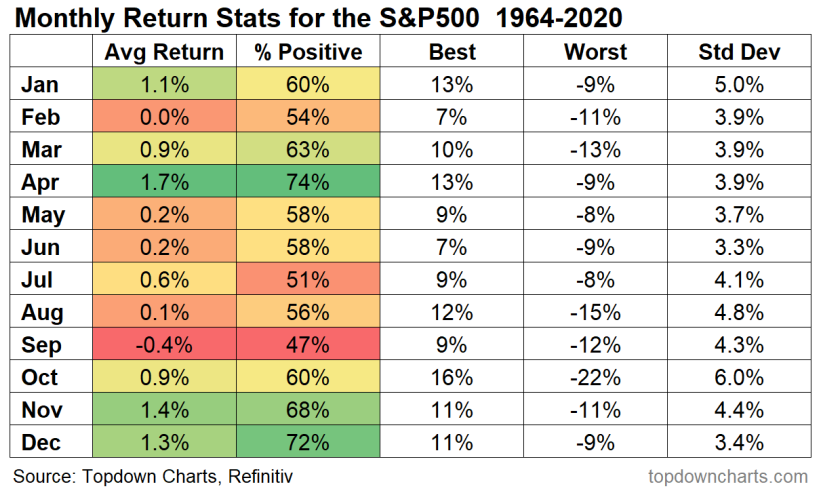

In fact, while March was a good month, April may be even better according to the average of April months for the S&P500 index dating back to 1964. The table below, (hat tip to topdowncharts.com) shows that April, on average, has been the best month for the US sharemarket in the last 56 years.

Don’t read too much into this and remember you can drown in a stream that averages only one metre deep.

Within the core market segments, Australian listed property (A-REITs) was the standout gaining 6.56% during March.

The gain in A-REIT’s was partially assisted by a leveling off in the rapid rise in interest rates that we remarked on recently. The ten year Australian government bond yield finishing February at 1.85% yield, but during March it rode a series of waves up and down to finish the month at 1.80%.

That helped the Bloomberg 0+ years index to gain 0.74% for the month reversing some of the loss of the previous month.

Although US long term bond yields continued to rise during March, finishing at 1.75%, the spread between the yields on government bonds and corporate bonds continued to narrow, helping to offset losses. The High Yield bond index in America, which provided a yield of 3.57% above the equivalent maturity government bonds at the start of March ended the month at a yield of only 3.36%. That ‘compression’ of bond yields in the amount of 21 basis points helped most of the bond funds to eke out a positive return for the month,

If you want to get more involved with your superannuation, investments or insurance, please give us a call at Quill Group.